Dublin, July 02, 2024 (GLOBE NEWSWIRE) — “Global Genotyping Assay Market by Product and Services (Kits, Instruments, Bioinformatics), Technology (PCR, Sequencing, Microarray), Application (Pharmacogenomics, Animal Genetics), End User (PharmaBiotech Companies, Diagnostic Laboratories) – Forecast Report to 2029” has been added to ResearchAndMarkets.com’s The offer of

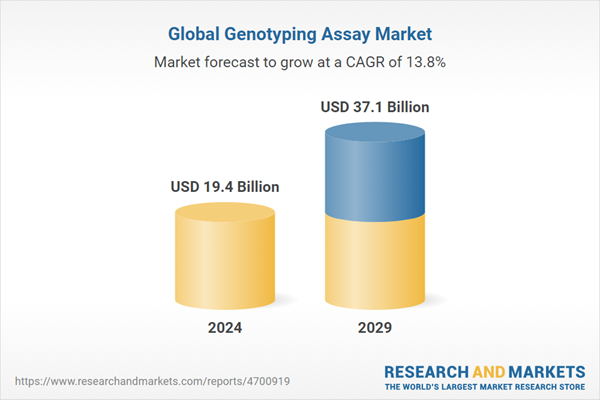

With a CAGR of 13.8% during the projection period, the genotyping assay market is expected to grow from USD 19.4 billion in 2024 to USD 37.1 billion in 2029.

Advances in technology and falling costs of DNA sequencing are expected to drive the growth of this market. Recently, the industry has grown at a slower pace due to the increased prevalence of hereditary diseases. Furthermore, the field of personalized medicine and drug development has made genotyping a major component.

Market opportunities are anticipated to arise from the need for genome analysis in plant and animal life, an increasing emphasis on national sequencing programs aimed at establishing genetic associations with disease, and expanding areas of genotyping applications. On the other hand, market expansion may be somewhat hindered by the high cost of equipment.

The reagents and kits segment accounted for the highest CAGR

By product and service, the market is primarily segmented into reagents and kits, instruments, GENOTYPING ASSAY services, and bioinformatics. The reagents and kits segment accounted for the largest share of the genotyping assay in 2023. Availability of a wide variety of reagents, growing demand for reagents due to the increasing volume of GENOTYPING ASSAY tests performed worldwide, and relatively initial cost the lowest necessary to implement reagents and kits for GENOTIPING analysis in pharmacies and diagnostic facilities are all responsible for the size of this segment.

The polymerase chain reaction (PCR) segment accounts for the market share of the genotyping assay market, by technology, during the forecast period

By technology, the market is primarily segmented into polymerase chain reaction (PCR), microarrays, capillary electrophoresis, sequencing, matrix-assisted laser desorption ionization time-of-flight (MALDI-TOF), and other technologies (in situ hybridization and allele- specific oligonucleotides). The PCR segment accounted for the largest share of the GENOTYPING ASSAY technology market in 2023.

The major factors driving the growth of the PCR market are the introduction of new technologies such as reverse transcriptase PCR, nested PCR, hot-start PCR, allele-specific PCR, and multiplex PCR; technological developments in PCR instruments and reagents; and the increasing use of PCR technologies in the fields of genetics, prenatal testing, forensics, and personalized medicine.

The pharmacogenomic segment has the highest weight

By application, the market is primarily segmented into pharmacogenomics, diagnostics and personalized medicine, agricultural biotechnology, animal genetics, and other applications. The pharmacogenomics segment accounted for the largest share of the GENOTYPING ASSAY applications market in 2023.

The main growth drivers in this market are the increasing need for pharmacogenomics to investigate adverse drug reactions (ADRs) in clinical trials and the demand to reduce the total cost of drug development for pharmaceutical companies. The growing need for personalized medicine, the rise of hereditary and life-threatening diseases, and ongoing research into effective and alternative drug delivery strategies are all predicted to drive the growth of pharmacogenomics genotyping testing.

The segment of biopharmaceutical and pharmaceutical companies has the highest weight

By end user, the market is mainly segmented into biopharmaceutical and pharmaceutical companies, diagnostic laboratories, academic and research institutes and other end users. The biopharmaceutical and pharmaceutical companies segment accounted for the largest share of the GENOTYPING ASSAY end-user market in 2023.

The growing need for pharmacogenomics in the drug development process, introduction of new products, and FDA recommendations to include pharmacogenomic studies and GENOTYPICAL SCREENING in the drug discovery process are all responsible for the size of this segment. Furthermore, the expansion of this market sector within GENOTYPING ASSAY is further facilitated by an increase in partnerships and funding for pharmacogenomic research.

Asia Pacific: The fastest growing region in the cancer biomarkers market

The global cancer biomarkers market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC countries. The Asia Pacific region is projected to register the highest CAGR during the forecast period, mainly due to increasing financial support from public and private agencies, increasing number of NGS-based research projects, increasing awareness of precision medicine and high incidence of chronic disease.

The report provides insights on the following points:

- Analysis of the main drivers (Technological advances and reduced prices of DNA sequencing, Increasing importance and use of genotyping in drug discovery and development), limitations (high costs of manufacturing, installation and maintenance of genotyping instruments), opportunities (Increasing application areas in genomics and genotyping analysis for animal genetics and agricultural biotechnology), and challenges (lack of adequate data management in genomics research) affecting genotyping analysis market growth.

- Product Development/Innovation: Detailed insights into future technologies, research and development activities, and new product and service launches in the genotyping assay market

- Market Development: Comprehensive information about profitable markets – the report analyzes the genotyping assay market in various regions.

- Market Diversification: Comprehensive information about new products, untapped geographies, recent developments and investments in the genotyping assay market

- Competitive Assessment: In-depth assessment of the market shares, growth strategies and service offerings of key players such as Thermo Fisher Scientific Inc. (USA), Illumina, Inc. (USA), Danaher Corporation (USA), Eurofins Scientific (Luxembourg) and QIAGEN (Netherlands). among others in the genotyping analysis market.

Main attributes:

| The report attribute | The details |

| number of pages | 371 |

| Forecast period | 2024 – 2029 |

| Estimated market value (USD) in 2024 | 19.4 billion dollars |

| Estimated market value (USD) by 2029 | 37.1 billion dollars |

| Compound Annual Growth Rate | 13.8% |

| Regions covered | global |

Companies profiled in the report:

- Thermo Fisher Scientific Inc. (USA)

- Illumina, Inc. (USA)

- Danaher Corporation (USA)

- QIAGEN (Netherlands)

- Eurofins Scientific (Luxembourg)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Bio-Rad Laboratories, Inc. (USA)

- Merck KGAA (Germany)

- Agilent Technologies (USA)

- Revvity Inc. (USA)

- Standard Bio Tools (US)

- PacBio (USA)

- GENEWIZ Inc. (USA)

- Luminex Corporation (Diasorin Company) (USA)

- Oxford Nanopore Technologies Plc (UK)

- GenScript (USA)

- Takara Bio Inc. (Japan)

- New England Biolabs (USA)

- Promega Corporation (USA)

- Tecan Trading AG (Switzerland)

- Genotypic Technology Pvt. Ltd. (India)

- BGI GROUP (China)

- Novogene Co., Ltd. (China)

- Paragon Genomics, Inc. (USA)

- NeoGenomics Laboratories (USA)

For more information about this report, visit https://www.researchandmarkets.com/r/gsjyf8

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, leading companies, new products and the latest trends.

-

Global Genotyping Assay Market

#Global #Genotyping #Assay #Market #Research #Forecasts

Image Source : www.globenewswire.com